DMARC MADE EASY

DMARC MADE EASY

Securing Insurance Communications - Explore challenges and how to overcome

The insurance industry deals with a vast amount of sensitive information, including policyholder data, claim details, and financial transactions. Email is a critical channel for communications with clients, brokers, and regulatory bodies. However, this reliance on email also exposes insurance companies to significant risks such as phishing, email spoofing, and data breaches. Ensuring robust email security is essential to protect sensitive information, maintain client trust, and comply with industry regulations.

Why DMARC Essential for Securing Insurance Communications

DMARC (Domain-based Message Authentication, Reporting & Conformance) is vital for protecting email communications in the insurance sector. By implementing DMARC, insurance companies can authenticate their email domains, reducing the risk of phishing and spoofing attacks that could compromise client data and damage trust. DMARC ensures that only legitimate emails are sent from your domain, helping to maintain the integrity of insurance communications and protect sensitive information.

DMARC LOOKUPS

DMARC LOOKUPS

Challenges Faced by Insurance Companies in Cybersecurity

Regulatory Compliance

Insurance carriers are often finding themselves susceptible to regulatory obligations for protecting data, which is only becoming more exhaustive and difficult to manage as regulations change and grow.

Sensitive Data Protection

As insurance companies tend to manage voluminous amounts of sensitive customer information - such as personal and financial information, they are prime targets for cyberattacks and data breaches due to the sensitivity of the information being stored.

Phishing and Fraud Prevention

Insurance companies are frequent targets of phishing and fraud schemes, and therefore require protections that financial institutions would require to safeguard against these threats and protect the integrity of any communications.

Legacy Systems and Integration

Many insurance companies utilize outdated legacy systems that are time-intensive and difficult to integrate with modern cybersecurity solutions, making them increasingly susceptible to attacks and harder to secure in response to threats.

How DMARC Can Benefit You

Discover how DMARC can help prevent unauthorized communication

sent on behalf of your insurance business.

Watch our animated video featuring the fictional NP Insurance

company and learn about the aftermath of a phishing attack. Gain

insights into the steps they took to mitigate future incidents.

DMARC LOOKUPS

DMARC LOOKUPS

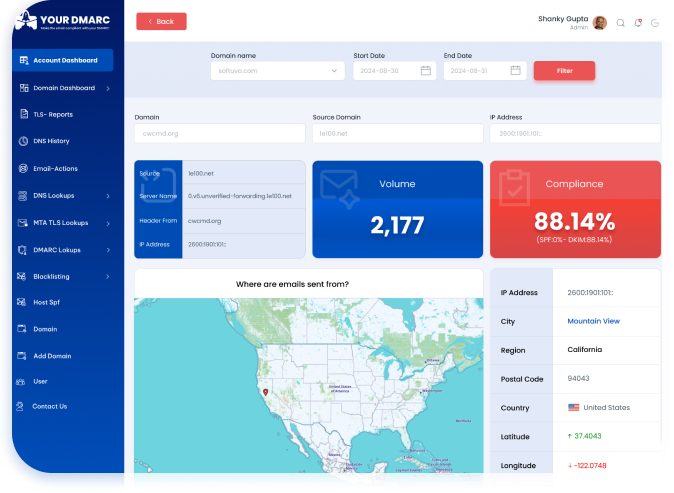

Enhancing Security and Trust with Your DMARC

Enhance security, ensure compliance, and build client trust with Your DMARC, protecting sensitive data and supporting seamless insurance operations.

Strengthen Protection Against Email Threats

Your DMARC enhances security, guarding the insurance industry from email-based threats and attacks.

Ensure Regulatory Compliance

Your DMARC supports adherence to regulatory standards, reducing the risk of data breaches and associated penalties.

Maintain Client Trust and Safeguard Information

By securing email communications, Your DMARC preserves client trust and protects sensitive insurance data, ensuring smooth operations.

Ensuring Compliance with DMARC Standards.

Insurance companies must adhere to stringent regulatory and compliance standards, including regulations such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation). Your DMARC supports compliance with these regulations by offering robust email security solutions that protect client data and ensure the confidentiality of communications. Our platform helps align your email practices with regulatory requirements, reducing the risk of non-compliance and associated penalties.

Fortifying insurance companies with specialized compliance tools to safeguard client information and ensure secure communication.

Tailored Solutions for Insurance

Your DMARC delivers specialized solutions designed to meet the unique needs of the insurance industry, whether managing claims, policies, or client interactions.

Advanced DMARC Tools

Our platform offers advanced tools for managing and enforcing DMARC policies, ensuring secure email communications across all insurance operations.

Enhanced Security and Compliance

Your DMARC adapts to your specific requirements, helping you secure communications, protect sensitive data, and maintain regulatory compliance.