DMARC MADE EASY

DMARC MADE EASY

Email Security in Finance: Key Challenges and Solutions

The finance industry is tasked with managing vast amounts of sensitive financial data, including customer account information, transaction details, and investment records. The integrity of email communications is critical in this sector, as financial institutions are frequent targets of cyber threats. Phishing, email spoofing, and ransomware attacks can jeopardize confidential financial information and undermine trust in financial institutions. Ensuring robust email security is essential to protect client data and maintain operational stability.

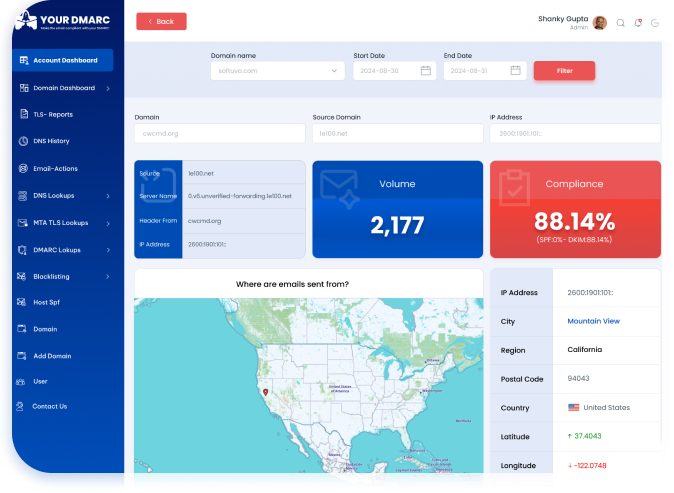

Why DMARC Essential for Securing Financial Communications

DMARC (Domain-based Message Authentication, Reporting & Conformance) plays a vital role in protecting email communications in the finance sector. By implementing DMARC, financial institutions can authenticate their email domains, reducing the risk of phishing and spoofing attacks. This helps to prevent unauthorized use of the institution's name, secure client communications, and protect sensitive financial data from cyber threats. DMARC ensures the integrity of email exchanges and supports the safeguarding of confidential information.

DMARC LOOKUPS

DMARC LOOKUPS

Challenges Faced by the Finance Sector in Cybersecurity

High-Value Targets

These organizations manage substantial amounts of sensitive financial information, and hence, a financial institution is particularly vulnerable as a cyberattack target for hackers who would like to steal money or personal info.

Complex Regulatory Requirements

Finance organizations deal with intricate regulatory and compliance requirements such as GDPR and PCI DSS that appear hard to implement and maintain.

Advanced threats

Involves new and sophisticated threats consisting of ransomware, insider threats as well as APTs that need advanced security systems and vigilance.

Legacy Systems

Financial institutions are utilizing legacy systems, which are antique and outdated. Most legacy systems are insecure because patching vulnerabilities and integrating modern security solutions cannot be easily done in such infrastructure.

DMARC LOOKUPS

DMARC LOOKUPS

Enhancing Security and Trust with Your DMARC

Boost financial security, ensure compliance, and build trust with Your DMARC, protecting data and operations.

Strengthen Defense Against Email Threats

Implementing Your DMARC offers robust protection against email-based threats, shielding financial services from potential attacks.

Enhance Regulatory Compliance

Your DMARC ensures adherence to industry regulations, minimizing the risk of data breaches and associated fines.

Preserve Client Trust and Protect Financial Data

By securing email communications, Your DMARC helps safeguard sensitive financial information and ensures smooth operations, boosting client confidence and supporting business success.

Meeting Compliance and Regulatory Standards with Your DMARC

The finance industry is subject to rigorous regulatory and compliance standards, including regulations such as GLBA (Gramm-Leach-Bliley Act), SOX (Sarbanes-Oxley Act), and GDPR (General Data Protection Regulation). Your DMARC supports compliance with these regulations by providing robust email security solutions that protect financial data and ensure the confidentiality of client information. Our platform helps institutions align their email practices with regulatory requirements, mitigating the risk of non-compliance and associated penalties.

Strengthening financial institutions with customized compliance tools to secure sensitive data and maintain trust.

Tailored Solutions for Finance

Your DMARC offers specialized solutions designed to meet the unique needs of the finance industry, including banks, investment firms, and insurance companies.

Advanced DMARC Tools

Our platform provides advanced tools for managing and enforcing DMARC policies, ensuring secure email communications throughout financial operations.

Enhanced Security and Compliance

Your DMARC helps secure client interactions, protect financial transactions, and maintain regulatory compliance, adapting to your specific requirements.